Ambiguity Aversion – Everything You Need to Know

Ambiguity aversion describes a common cognitive bias that happens when we need to make a choice and some information is missing. Here’s everything you need to know about this behavioral economics concept.

Article content:

Ambiguity aversion defined

In behavioral economics, ambiguity aversion (some call it the ambiguity effect or uncertainty aversion) is an irrational tendency to prefer the known over the unknown.

Discover ground-breaking ideas and fascinating solutions.

Ambiguity aversion is also used to describe a bias towards known risks over unknown risks, even at a cost.

Say you’re on a road trip. Your motel for the night can be reached one of two ways: down a long, boring stretch of highway that your maps app recommends. Or, via a random signpost you’ve noticed – which could be a shortcut.

Ambiguity aversion is an irrational tendency to prefer the known over the unknown.

A person displaying ambiguity aversion would favor taking the highway, even though it’s a tough drive and there’s a chance the unknown route could be better.

Ambiguity aversion can be summed up by the phrase “well, at least this way, I know what’s going to happen.”

How does it work?

Ambiguity aversion exists because we dislike uncertain situations. When presented with the unknown we’ll often spend more time thinking about potential drawbacks than potential benefits, leading us to avoid ambiguous options.

This isn’t the same as risk aversion, where a person believes they know the odds of all outcomes and chooses the smaller risk, even if it incurs greater costs.

How ambiguity aversion works

Let’s look at an example. Imagine you have $10,000 to invest and are considering where to put your money. Your financial advisor gives you three options:

Option 1 – Put your money in a high-interest savings account that’s guaranteed to earn $100.

Option 2 – Invest your money in a high-risk stock portfolio, which has a 50% chance of earning $200, but a 50% chance you won’t earn anything.

Option 3 – Invest your money into a company that your advisor doesn’t know much about. You might earn $200, but you might also earn nothing.

All of these options have the same expected return, but they contain different levels of ambiguity or risk.

- Option one contains no risk or ambiguity. There’s a 100% chance you’ll earn $100.

- Option two contains risk, with higher potential earnings but an expected return of $100 (50% X $200).

- Option three is ambiguous. It also offers higher potential earnings, at unknown odds. Those odds might be lower than option two’s 50%, but they might equally be higher. Again, that’s an expected return of $100.

Despite each option offering the same probable return, most people would choose option 1 over option 2, with option 3 ranking last. Although we have an aversion to risk, we have an even stronger aversion to ambiguity or the unknown.

How ambiguity aversion works in marketing

Ambiguity aversion is a sales deterrent. The more uncertain we feel about a product or service, the less likely we are to purchase it. This can be true even if a product has other industry-leading features to separate it from the competition.

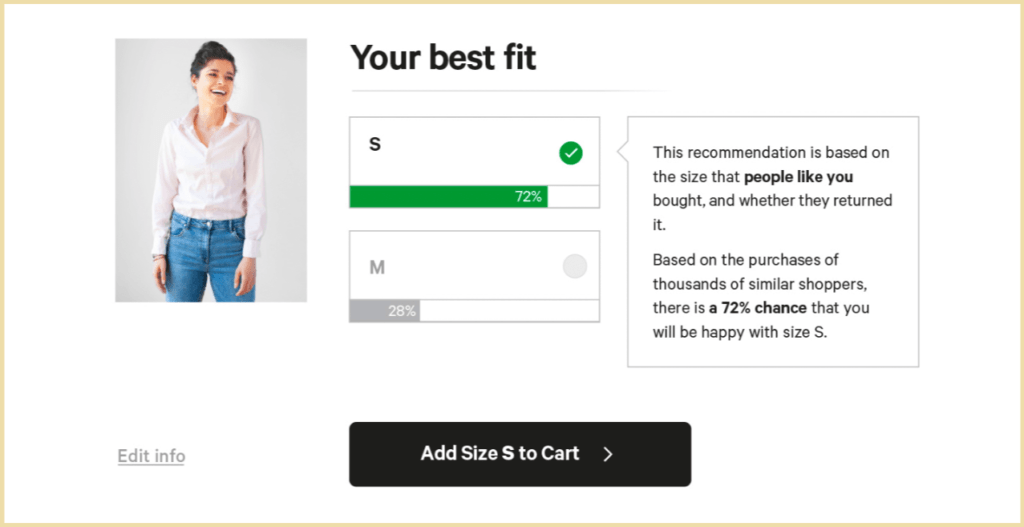

To avoid ambiguity, marketing teams constantly assess the amount of information available to customers or users, checking for knowledge gaps. Clothing companies want you to feel confident about their sizing, manufacturing processes, and returns policies, while streaming services are eager to assure you that you can quit anytime.

Source: Fitanalytics

How ambiguity aversion works in business

Just as ambiguity creates hesitant customers, it can also cause companies and institutions to become static and resistant to change.

Fully predicting the results of new business models is difficult, so uncertainty often exists in proposed changes. Even in cases where current processes are inadequate, ambiguity aversion can cause people to stick with less beneficial, but more predictable, systems.

Why it works

Ambiguity aversion works because most people dislike uncertainty and naturally try to avoid it. But there’s no widely accepted explanation for why uncertainty is distasteful to so many.

Psychologists do know that different people display different levels of ambiguity aversion. Some studies have suggested that women are less ambiguity averse than men – though the evidence isn’t conclusive.

Evolution

It’s possible our ancestors evolved to become ambiguity averse as a safety mechanism.

Early humans who opted for unknown opportunities in daily life (where to hunt, which berries to eat) may have encountered unwanted results more often than not, making ambiguity aversion a heuristic that was naturally selected over time.

The impact of ambiguity aversion

Many of us will have noticed the impact of ambiguity aversion whenever we’ve had to make important or difficult choices.

Ambiguity aversion can make us play it safe and hesitate in situations where stepping into the unknown would be the beneficial option.

The bias means we often focus on things that could go wrong in uncertain situations, and forget that when the odds are unknown, there’s an equal possibility that taking a risk will improve our situation.

As a result, ambiguity aversion can make us play it safe and hesitate in situations where stepping into the unknown would be the beneficial option.

Ambiguity aversion experiments

There are dozens of studies and papers demonstrating ambiguity aversion across economics, social interaction, and decision-making. Here are a few examples:

Ambiguity and medical diagnoses

Berger et al. wrote a 2013 paper in the Journal of Health Economics, detailing how people react to ambiguity in medical settings.

The paper finds that ambiguity can have different effects on whether patients opt for treatment, depending upon the source of uncertainty.

If there is “ambiguity regarding the diagnosis of a patient,” Berger found that people tend to compensate for that ambiguity by opting for treatment. However, when there’s “ambiguity regarding the effects of treatment,” patients will often try to avoid it by not having that treatment.

Individual vs group decisions

A 2015 study from the UK looked into levels of ambiguity aversion in individuals compared to those in group settings.

Participants were asked to enter into a series of “Safe” and “Risky” lotteries. Researchers found that groups “tend to be less risk averse and more ambiguity averse” than individuals when faced with the same decision.

Judging risk and ambiguity

In their 2010 paper, Levy et al. wanted to find how the brain deals with risk versus ambiguity. They studied fMRI scans of participants as they were given money-lending scenarios involving both risk and ambiguity, and found that the same areas of the brain were responsible for assessing potential value in both situations.

Participation in the stock market

Easley and O’Hara’s 2009 paper looked at how the presence of ambiguity affects the behavior of market traders. They found that legal systems can have a real effect on how active traders are in the market by increasing the regulation of unlikely events – thereby reducing ambiguity.

The history of ambiguity aversion

The first and most famous experiment demonstrating ambiguity aversion was by the economic theorist Daniel Ellsberg, in 1961.

His paper, “Risk, Ambiguity, and the Savage Axioms”, doesn’t define ambiguity aversion, instead proposing its existence through a neat thought experiment that’s now referred to as the Ellsberg paradox.

The Ellsberg paradox

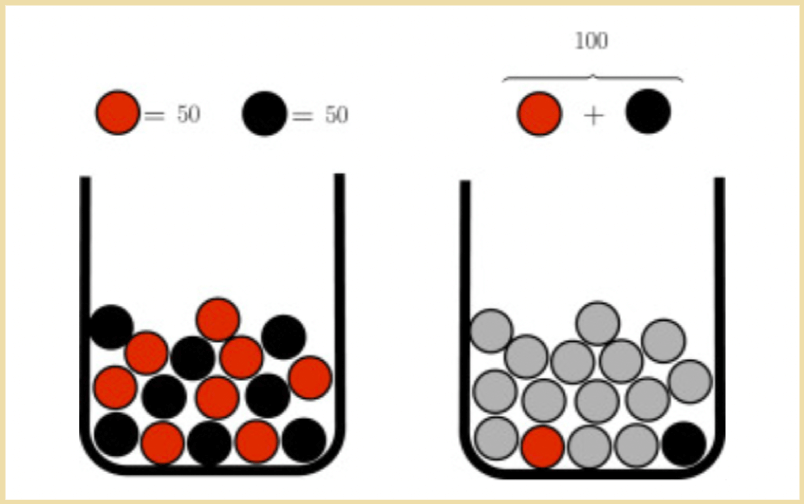

Imagine you’re playing a carnival-style game, where you have to pick a ball at random from one of two urns.

Each urn is filled with a mixture of 100 red and black balls. Picking out a red ball will win you $100 while picking a black ball means you go home empty-handed.

Urn 1 contains some combination of balls, but you don’t know how many are red or black. Urn 2, on the other hand, contains an equal split of red and black balls.

Which urn do you choose to play with?

Ellsberg predicts (and later experiments confirm) that “if you are in the majority, you will report that you prefer to bet on Red 2 rather than Red 1.”

That’s the urn with the known 50/50 split of balls over the urn with the unknown split.

Here’s how the paradox uncovers ambiguity aversion bias

Theoretically, the winning probability of both urns is the same. While the chance of winning with urn 2 is 50%, there’s also a 50% percent chance that urn 1 will contain a better mix of balls.

Despite the equal odds, most people opt for the urn with the known distribution of red balls, suggesting a bias against ambiguity.

(Ellsberg’s original example has players bet on the color of a chosen ball to win – but this simplified version is equivalent).

Source: ScienceDirect

Ambiguity aversion vs risk aversion

The history of ambiguity aversion is closely connected to a similar bias: risk aversion.

- Ambiguous and risky events have subtle differences. An event is risky if it has a probability. That is, you can calculate the chance of it occurring.

- Ambiguous events have a greater degree of uncertainty. An event is ambiguous if you don’t know how likely it is.

While researchers have struggled to find ways to predict whether a person will display ambiguity aversion, risk aversion has been linked to personal characteristics such as IQ and ambition.

Here’s our full guide to risk aversion for more:

How to avoid ambiguity aversion

Beating a heuristic like ambiguity aversion can be tricky as it requires self-awareness – an ability to notice a natural behavioral tendency and override it.

But it’s definitely not impossible, and the more you practice avoiding ambiguity aversion, the easier it should become to see when you’re exhibiting it.

Framing effects

The best way to avoid ambiguity aversion is to reframe alternative choices so that decisions become less binary when it comes to uncertainty.

Is there really such a thing as an event with 0% uncertainty? Or is it possible to find ambiguity in any situation if you focus on the things you don’t know?

Let’s go back to the road trip example. Ambiguity aversion says most people would prefer to stick with a safe, planned route than taking an unknown potential shortcut. But there are many unacknowledged unknowns about the planned route that, if recognized, help to balance the ambiguity in each option:

- There could be a sudden accident on the highway

- Your maps app may have made a mistake

- It could be a more boring drive than you anticipated

- The weather could be worse in your planned direction

- There might be unannounced construction work.

While heuristics like ambiguity aversion make certain options feel safer and easier, they can also prevent us from making objective assessments.

Some behavioral scientists have described ambiguity aversion in its entirety as a framing effect, where ambiguity is defined only by which unknown elements you choose to focus on.

Source: Freshworks

Optimism

It might also pay to be more optimistic. Researchers have found that highly optimistic people are less ambiguity averse than pessimistic people, perhaps because they’re better at considering the benefits of unknown situations.

Ambiguity aversion examples

Still struggling with the concept of ambiguity aversion? Here are some everyday examples.

The stock market

Investing in the stock market can increase your savings and produce passive revenue – so why don’t more people do it?

Because stocks come with lots of uncertainty in the form of volatility, triggering ambiguity aversion and a bias for safer, lower yield options.

Subscription services

In competitive spaces like streaming, ambiguity aversion can be the difference between gaining a subscriber and losing out to the competition. Industry leaders like Netflix constantly assess their signup process for points of uncertainty that might trigger ambiguity aversion.

That’s why you’re likely to see a greater focus on potential concerns than product features when signing up for a new subscription service. For example, a company may try to predict and reduce uncertainty around free trials (“You won’t be charged until after your free month”) or contract terms (“Cancel anytime.”)

The insurance industry

Many insurance plans are built in the knowledge that we’re predisposed to overestimate the likelihood of harmful events. Here, ambiguity aversion (and risk aversion) can tempt us into safer, costlier policies that most of us will never use.

Healthcare

The ambiguity effect crops up in medicine in both patients and doctors. Medical professionals can be biased towards treatments they’re already familiar with, while patients can experience ambiguity aversion when doctors don’t sufficiently explain new treatment plans.

Restaurant menus

Research shows that people tend to stick with a “safe” restaurant order if they feel that a menu doesn’t give enough information about meals or drinks.

When Cowry Consulting redesigned the menu of Browns Brasseries & Bar, they found that the cocktail list was sparking uncertainty, with customers unsure how the drinks would look when they arrived.

Changing the menu to include visuals for glassware reduced uncertainty and increased the average customer spend.

Source: Reddit

Combatting ambiguity aversion in business

Ambiguity aversion in consumers can be hard to spot, especially if a business is focused more on promoting product features than reducing uncertainty.

Here are some of the most common marketing strategies used by companies to prevent this behavioral bias and retain conversions.

Brand power

Ambiguity aversion says that customers will tend towards more familiar options. When presented with a choice of products, this results in a preference for established brands.

When a 2009 paper studied uncertainty and brand familiarity, they found that people will even stick with an established brand’s product when lesser-known alternatives are superior in all other attributes.

Brands with authority fare better among ambiguity-averse customers because familiarity reduces feelings of uncertainty. Selling products under an established name can reframe ambiguity, introducing trust and making alternative products seem like riskier options.

The researchers surveyed shoppers on which computer they’d prefer to buy. One was cheaper with higher disk space, but from a less-established brand, Compaq. The other was from a more established brand, Dell, but was more expensive with less disk space.

A majority of shoppers chose the Dell computer, and that majority increased when prices were hidden.

Brands with authority fare better among ambiguity-averse customers because familiarity reduces feelings of uncertainty. Selling products under an established name can reframe ambiguity, introducing trust and making alternative products seem like riskier options.

Social proof

Similarly, when experiencing uncertainty, customers will look to other shoppers for clues about which products are the safer choices.

Providing social proof is a popular way to add this kind of information into sales funnels. Companies include reviews, testimonials, and likes – although even the knowledge that other people are browsing a product can be enough to decrease feelings of uncertainty.

Just remember that neutral or negative social proof can have the opposite effect, increasing uncertainty around a product. Social proof can become an issue if the majority of customers are choosing a competing product, or if there’s a lack of proof (few reviews, little market information, etc.)

For more on adding social proof to transactions, here’s our full guide:

Source: instapage

Addressing uncertainty vs promoting features

Having a balance between marketing that explains product benefits and deals with customer concerns is crucial to addressing ambiguity aversion.

Because we have a bias towards familiarity, a lack of information can outweigh a standout product feature. Likewise, working to remove customer uncertainty can make for a much easier sales pitch.

In our full article on uncertainty, we cover common uncertainty triggers, such as commitment concerns, where customers look for reassurance that they’re able to step away from services if they change their minds later on.

Summary

What is ambiguity aversion?

Ambiguity aversion describes a behavioral bias towards known outcomes. When making decisions, people tend to choose options with greater familiarity or more predictable outcomes, even if pure rationality says there’s no reason to.

Why does it happen?

Ambiguity aversion arises from a heuristic for predictable outcomes that may have been an evolutionary advantage.

It happens because we tend to focus on possible negative outcomes in unknown situations and underweight the potential benefits of stepping into the unknown. We may also feel more satisfied with familiar choices, even if they cost us more.

How can we avoid ambiguity aversion?

As a natural bias, ambiguity aversion can be hard to avoid. But it can be addressed by consciously reframing situations to reveal hidden uncertainties on all sides of a decision. Some studies also suggest that having an optimistic attitude can make you less likely to overweigh negative possibilities.

In business, ambiguity aversion is combated by building trustworthy brands and reassuring customers through social proof mechanisms. Companies look for points of customer uncertainty in the funnel and add content to reduce uncertainty.