Case Study: A Fashion Brand Changed Product Descriptions and Increased Online Conversion by 51%

In this case study, you’ll discover:

- What common mistakes companies make when designing communication;

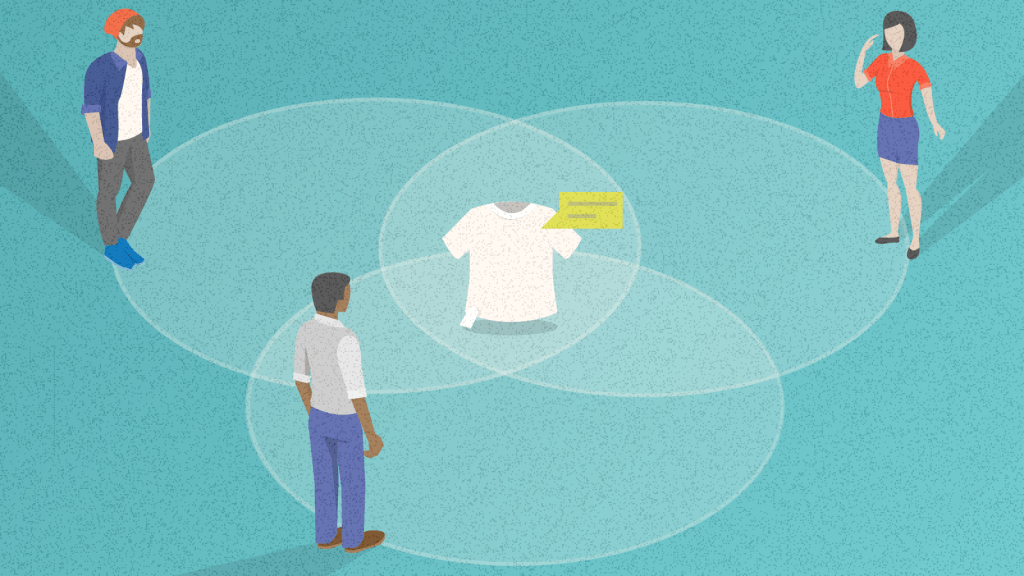

- Why grouping customers according to age or purchase history will not give you the maximum value and what grouping works better;

- Why you should not fixate on distinct messages for different groups but find common threads to weave into a single message line; and

- How a single statement can speak precisely to your target audience’s different motivations and needs.

Unlock to continue reading.

Unlock this case study – 9,90€, or

all 60+ case studies – 149€

Or get lifetime access to all of InsideBE for 790€ here.