Pain of Paying – Everything You Need to Know

Article content:

Definition of Pain of paying

The pain of paying refers to the negative emotions people experience when they have to pay for goods or services. The level of that pain is affected by the payment method and the timing of the payment.

How does it work?

Scroll back in your memory to that one time when you were standing staring at the cashier, then staring at the price, then back at the cashier. Then try to recall the negative emotion you felt when you had to hand over a bunch of cash, as you had left your credit card at home.

Discover ground-breaking ideas and fascinating solutions.

You’re used to paying with credit cards, so this negative feeling left you feeling uncomfortable. You started questioning why you felt so bad, as you never normally feel that way when paying by card. Don’t worry – this is a common feeling, known as the pain of paying.

Cash physically represents money, and when we hand cash to the cashier, we are experiencing loss. This is something that we feel way less when we pay by credit or debit card.

Dan Ariely clearly explains this effect in one of his videos:

Source: YouTube

Why does it work?

To explain that we need to look at the processes happening in our brains.

In 2007 Brian Knutson et al. studied the pain of paying and its neural effects, and they came up with surprising results. They found that when we’re faced with prices that we perceive as too high, one part of our brain starts to react – the insular cortex. As the insular cortex is not only responsible for receiving sensory information from the environment, but also for feelings of pain, it can identify the act of paying (especially for prices that we think are too high) as something close to physical pain.

Pain of paying experiments

The effects of payment on our well-being have been studied for decades now.

Brain scans: Credit cards vs. cash

A study conducted by researchers at Carnegie Mellon, Stanford, and MIT, looked at the mental processes that drive customer decision-making, and explained why it’s easier for us to pay with credit cards than with cash.

Credit cards effectively anesthetize the pain of paying.

According to George Loewenstein, “Credit cards effectively anesthetize the pain of paying.” This explains why you felt so bad when you were handing the money to the cashier. As he explains, when we swipe a plastic credit card, it doesn’t feel like we’re giving away anything.

The study looked at the behavior of 26 participants. Each participant was given $20 to spend on different products ranging from a digital voice recorder to a Harry Potter book to very fine chocolate.

The price tags of these items were shown to them after a few seconds. If they wanted to buy something, the price was deducted from their $20. If they didn’t make any purchases, they could keep the money.

During the decision-making process and subsequent purchase, the participants lay in a functional magnetic resonance imaging (fMRI) scanner while the parts of their brains were studied.

Source: Forbes

The researchers discovered that when the participants were exposed to an item, the nucleus accumbens region of their brain was activated – the area responsible for the dopamine reward pathway, which is activated by different types of anticipated pleasure.

Here comes the surprising discovery. When the participants were exposed to a price tag, the insular cortex and prefrontal cortex showed activation. The insular cortex excludes aversive feelings, caused by things like seeing people in pain or experiencing a nicotine withdrawal, with the result that we try to avoid such situations.

Surprisingly, spending money triggers the same effect, meaning that participants felt discouraged from making a purchase when prices were too high.

Bidding: Credit cards vs. cash

Another study, by MIT professors Drazen Prelec and Duncan Simester, focused on how we pay. They created a real-life auction for tickets to a Boston Celtics basketball game and divided their students into two groups.

The first group was told that they had to pay in cash to attend the Boston Celtics game, while the other group had to make the purchase using a credit card. The results were astonishing.

The average bid from the group using a credit card was almost twice as high as the average bid using cash. Surprisingly, people using their Visa or Mastercard were willing to pay far more than those having actual cash in their wallets.

The average bid from the group using a credit card was almost twice as high as the average bid using cash. Surprisingly, people using their Visa or Mastercard were willing to pay far more than those having actual cash in their wallets.

To sum up, the insular cortex doesn’t understand credit cards like it does cash. It’s just a piece of plastic, and it doesn’t feel like we’re giving anything away, as the transaction is abstracted. This encourages us to spend more money than we would when making payments using cash.

Donations: Cash vs. voucher

Professor Avni M. Shah, along with her colleagues Noah Eisenkraft, James R. Bettman, and Tanya L. Chartrand, decided to study how payment method influences post-transaction connection.

The team gave $5 to each of their participants, who then had to decide and donate the amount to one of three causes. The subjects were divided into two groups, with the first group receiving $5 in cash, and the second receiving a voucher. All the participants were given a ribbon to wear after they donated.

Around half of the subjects from the cash group wore the ribbon, compared to only 14% of the participants from the voucher group.

So, who wore the ribbon more proudly? According to the results of the study, around half of the subjects from the cash group wore the ribbon, compared to only 14% of the participants from the voucher group.

This suggests that if we pay with our own money in a physical form (cash), we feel a stronger emotional connection to whatever we spend that money on.

History

The traditional view of economics regarding payments is rational rather than emotional. Back in 1930, Irving Fisher’s theory claimed that people make payments without any emotions attached to the experience itself. All they want is to get the best deal.

Fisher was aware that his theory lacked any emotional perspective, which was psychologically unrealistic. That was one reason why Ofer Zellermayer decided to study the effect of emotions on consumer decision-making.

In 1996, Zellermayer, under the supervision of George Loewenstein, first presented and explained the concept of the pain of paying in his Ph.D. dissertation. Zellermayer recognized different reactions when people were making payments. Some felt bad, experiencing something similar to pain, yet some felt joyful.

Thanks to Zellermayer, emotions were considered in the whole purchase process. In addition, the emotions experienced were differentiated based on individual characteristics. You might think that when you have to pay more, it hurts more. But Zellermayer proved that in fact, this does not influence the pain of paying as much as other contextual factors.

Zellermayer identified six important characteristics of payment which can lessen the experience of pain when paying. That pain will be lower if:

- The purchase is perceived as fair;

- It is seen as an investment and not simply for consumption;

- Payment is immediate rather than spread out;

- The purchase is for someone else;

- Consumers feel like they’re in control of their choice;

- Payment is completed before consumption.

All the above characteristics are linked to mental accounting. To keep it short and simple, this concept breaks down how consumers subjectively perceive spending the same amount of money based on their criteria.

For example, they might try to save every penny in their local supermarket, but when they go on a vacay and visit the local market over there, they don’t mind digging deeper into their pockets. To learn (much) more about this concept, check out our article below.

It was in 1996 that Zellermayer’s work sparked an interest in researchers, and since then, the pain of paying has come to be studied more and more extensively by others.

Let’s rewind to the year 1998 when Drazen Prelec and George Loewenstein studied the mental accounting of savings and debt. They introduced a double-entry mental accounting theory to describe “the reciprocal interactions between the pleasure of consumption and the pain of paying”. They outlined two concepts:

- Prospective accounting – enjoyment of goods and services is greater if payment is made before consumption

- Coupling – the degree to which the consumer is reminded of payment during the consumption process or vice versa.

Because we don't look at our phone as purely a tool to make purchases, it's less uncomfortable for us when we use it to get whatever our heart desires. Thanks to this, the saliency of payment is decreased even more.

By now, we know that the experience of the pain of paying differs across different payment methods. We also know that we have more options than just credit cards or cash, and so did researchers Pisani and Atalay. These two researchers discovered in 2018 that mobile payment feels even less painful to us than credit cards, let alone cash.

According to Gafeeva, Hoelzl, and Roschk (2018), the reasoning behind this might be the multifunctionality of mobile phones. We use them to make calls, send texts, take photos, browse the internet and the list goes on. Because we don’t look at our phone as purely a tool to make purchases, it’s less uncomfortable for us when we use it to get whatever our heart desires.

Thanks to this, the saliency of payment is decreased even more.

Examples and case studies of the pain of paying

The magic of free

To be honest, it really does make our day better when we get something for free. It doesn’t matter what it’s worth, but the idea that we got it for free is enough to give us a boost. So, let’s talk now about free chocolate…

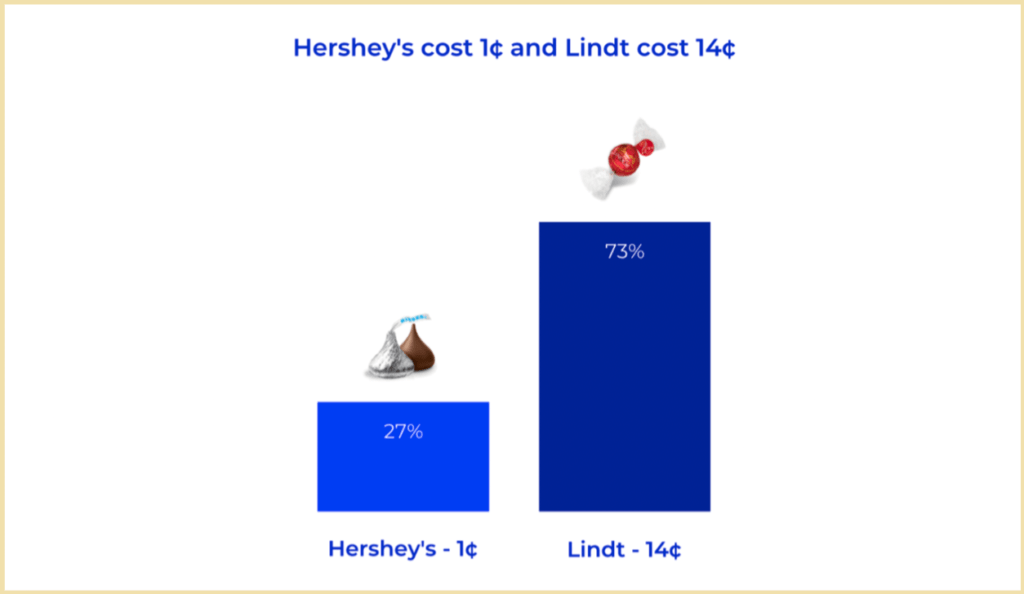

Let’s turn to a well-known name in this article, Dan Ariely. He and his colleagues studied whether people overvalue free products. The participants in their experiment were offered two types of chocolate: a well-known and inexpensive Hershey’s Kiss for $0.01 or a fancy chocolate truffle by Lindt for a whopping $0.14.

Let’s make a guess which of these two options was seen as the better deal and which people bought more of…

Source: Power of Free E-book

If you’re a saver, this result might surprise you. Almost 3 out of 4 participants chose the higher-priced chocolate. Why? It’s pretty simple. If you have to pay anyway, you might as well splurge a little and get yourself something special rather than save a few cents.

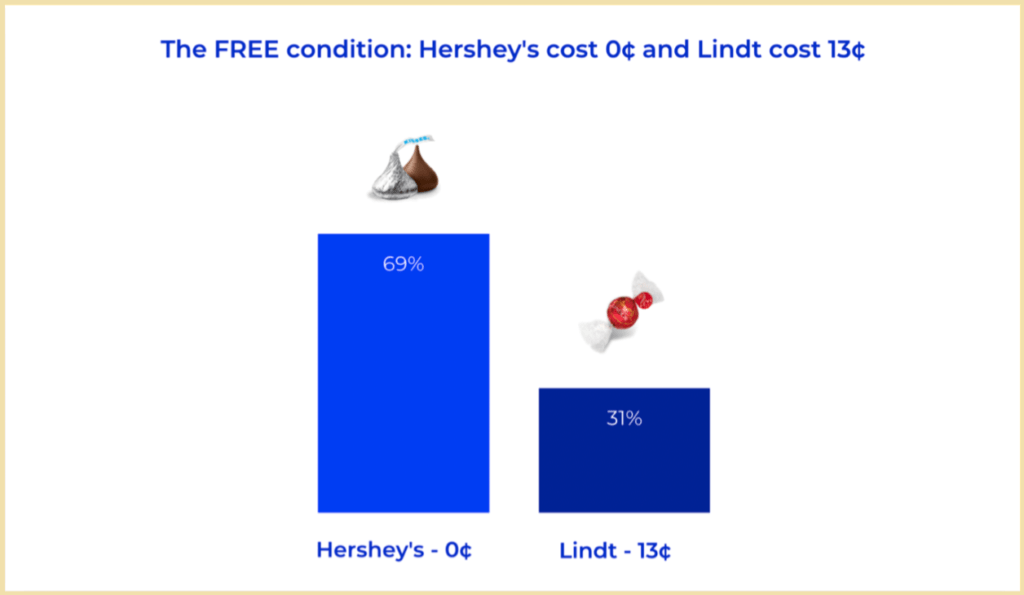

But now for a different scenario. The prices of both chocolates were reduced by 1 cent, leaving the Lindt product costing $0.13 and, yes, you got your math right, the Hershey’s Kiss was now free. So how did this affect the demand for the chocolates?

Source: Power of Free E-book

More than ⅔ of participants preferred the free chocolate over the one they had to pay for.

We can even label this as a violation of rationality, as the price difference stayed the same, yet people made a completely different choice.

The magic of bundling

Vineet Kumar, et al. collaborated and conducted a great study on how bundling products can reduce the pain of paying.

During a period between 2001 to 2005, they focused on Nintendo’s products such as their GameBoy Advance and GameBoy Advance SP consoles, and the games for both of these devices.

Their study showed that when Nintendo introduced a bundle option – a video game console and a game in one package, their sales spiked significantly. However, this only happened when there was a different offer available – the option to buy each item individually.

Implementing this “mixed bundling” offer resulted in an increase of approximately 100,000 more games console units being sold. But what was more incredible was that sales of software video games also increased by over a million units.

If customers were presented with only one option – “mixed bundling” – Nintendo sales would decrease. The same scenario would happen if no bundle was offered. Their sales decreased by 20% compared to the “mixed bundling” offer, meaning the sales of consoles declined by millions of units, and of software video games by over 10 million.

The magic of partially free

Free, what a magical word, right? It always catches our attention, even if it’s something we don’t need. Every business owner can take advantage of this word to reduce the pain of paying their customers might be experiencing.

Sure, you don’t want to give away your product for free, but if you play a little bit with the wording of your offer, you can end up selling your product for its full price and leave your customer feeling like they got something for free. Are you wondering how?

Let’s look at a real example to get a clearer idea.

This is a shoe offer you might see on a website:

- $45 + $10 shipping

- $55 + FREE shipping

- FREE + $55 shipping

Which of these offers do you think customers would go for?

If we were purely rational creatures, we’d see that all the prices are the same – $60 – and so it seems like a pretty stupid question, as it doesn’t really make any difference which we choose. But since irrationality plays a huge role in our decision-making, the best option appears to be the third one. Why? Because you’re getting the shoes of your choice for free! Who cares about the more expensive shipping?

This is a beautiful example presented by Dan Ariely, to remind us that we’re still affected by our emotions no matter how hard we try to stay rational.

To get your mind around it, check out Dan’s video lecture on a very similar example:

Source: YouTube

How to use it in business?

All customers, to some extent, are sensitive when it comes to money and the ways they spend it. Let’s look at some workarounds you can implement in your business strategies to ease their pain of paying.

The “pay-as-you-go” model is not a great one if you aim to reduce the pain of paying for your customers. We’ve collected a few alternatives for you, so keep on reading.

The pain of paying happens every time we pay in cash, and it doesn’t matter how much or how little money we spend. Each situation causes some psychological pain in our brain.

According to Dan Ariely’s research, the pain of paying happens every time we pay in cash, and it doesn’t matter how much or how little money we spend. Each situation causes some psychological pain in our brain.

Alternatives to the “pay-as-you-go” model

As we mentioned earlier, Dan Ariely recommends two strategies to use instead of the classic “pay-as-you-go” model.

Design payment cycles

Instead of asking your customers to pay every month, try asking for larger payments 2-3 times a year. Structure the payment cycles around periods when your customers are more likely to have extra money in their pockets. During the year, there are times when their expenses are likely to be way higher when compared to the rest of the year, such as the Christmas period.

Try to align your payment cycles to your customer’s cashflow, when they will be more willing to make one bigger investment over smaller but more frequent ones.

Try to align your payment cycles to your customer’s cashflow, when they will be more willing to make one bigger investment over smaller but more frequent ones.

Mobile payments

In the same research by Dan Ariely, he argues that the more abstract the expenditure is, the less painful it is to make a purchase. As we already know, it feels less harmful to us to use a piece of plastic rather than hard cash, and this applies even more to mobile payments.

The emotion of pain at this point would be diminished plus, as the amount is automatically deducted, customers would stop worrying about making the payment.

Upfront payments

Imagine this – you plan to go on that 2-week long cruise you’ve been dreaming of for years. Finally, the day arrives, and you’ve saved enough money to treat yourself. Now it comes to payment. What would feel less painful to you?

Would you prefer to pay for all the expenses upfront, so you can immerse yourself in all the benefits like fancy meals, drinks, events, and massages on the cruise and basically not worry about anything? Or would you prefer to pay for each item individually as you go?

Consumers prefer paying upfront, as it increases their enjoyment of an experience, service, or product and reduces the stress that comes with thinking about paying for it, as it feels like they’re getting it for free at the time of consumption.

We bet that the thought of the second option ruined your dream of the vacation and left you stressed and worried about your money.

Hey, it’s totally normal! Your preference to pay in advance is called prospective accounting. This phenomenon means that consumers prefer paying upfront, as it increases their enjoyment of an experience, service, or product and reduces the stress that comes with thinking about paying for it, as it feels like they’re getting it for free at the time of consumption.

Another option presented by Dan Ariely introduces an opposite approach. Enjoy your vacay, gradually gather your pain of paying, and then in one go at the end of the holiday, pay for it all.

This approach might, however, not be so good from the perspective of your memories and overall vacation experience.

Add bundles or packages to your offer

If you’ve made it this far, you’re already aware of the power of bundling as explained in the Nintendo case study. It’s a proven, effective strategy for reducing the pain of paying that your customer might experience when scrolling through offers.

Combining multiple goods into one package, with a slightly discounted price will leave your customers feeling great about the deal they've just gotten.

If you’re thinking about ways to sell more and keep your customers happy and coming back, sell your products or services in bundles. Combining multiple goods into one package, with a slightly discounted price will leave your customers feeling great about the deal they’ve just gotten.

Be generous (not literally)

Even though we see the word free almost everywhere, it still attracts our attention. It’s a very common strategy simply because it works.

One company, GetResponse, wanted to test it for themselves so they added a Free Trial button on their homepage. They tested whether this option would affect the number of purchased paid accounts and the number of new free accounts.

Let us squeeze in one word of caution. Human beings can be very smart at times and won’t be fooled by every free thing they come across. This happens occasionally, and when it does, we’re very skeptical about FREE, as sometimes it signals that the item has zero value.

It all lies in perceived value. If you’re eager to learn more about that, read our article on how to increase the perceived value of your product.

GetResponse were afraid of the same thing – that the Free Trial button would cause people to think that their product had no value.

Source: VWO

GetResponse weren’t discouraged though, and placed the “Free Trial” button next to the “Buy Now” button. This change triggered an avalanche of new free account registrations – to be precise, an increase of 158.6% compared to the home page with only the “Buy Now” button. And they needn’t have worried – the number of people choosing paid accounts was not affected.

The dangers of free

Once we get something for free, it’s a very unpleasant experience if we later get asked to pay for it. The same applies to your customers. If you once offer something for free, keep your hands off of it and keep it free for good if you don’t want to upset your customers.

Take a look at the App Store. If you’re an Apple product user, you’ve already noticed the number of free apps in the store. But often, immediately after clicking on an app you face the fact that if you want to enjoy its perks, you need to purchase an upgraded version. This fact discourages you and you totally lose interest.

If you want to turn off the human radar and address any uncertainties your customers might have about why the product is for free, what the catch is and so on, explain why your product or service is for free.

We’re hooked on getting the app for free, but the sudden change in price and pop-up gateway leaves us unhappy to admit that the app deserves to be paid for.

A remedy for our pain, according to Dan Ariely, could be that each and every app in the App store should cost at least $0.10, so nothing is available for free.

If you want to turn off the human radar and address any uncertainties your customers might have about why the product is for free, what the catch is and so on, explain why your product or service is for free. It’s a great way to improve the perceived value of your product in your customer’s eyes.

Left-digit-effect

Have you ever wondered about why the prices you see are often like $2.99 or $799.99, instead of just $3 or $800? Well, wonder no more – we’ve done the searching for you, and we’ve got you covered.

Your rational mind is like: “Well, it doesn’t make sense, why don’t they price the product with round numbers? It’s just one cent – why make it complicated?” And you’re totally right. But we can’t forget the fact that our minds also act irrationally.

People perceive nine-ending prices as smaller than those one cent higher when the first digits of the prices are different (e.g. $8.99 and $9.00). And when the two prices being compared are closer, it increases the power of this effect.

The left-digit effect is the real deal because you can apply it in any industry, and it still works! Nicola Lacetera, Devin G. Pope, and Justin R. Syndor focused on over 22 million wholesale used car transactions and discovered that car prices differed based on the car’s odometer values.

They found that cars with odometer values between 79,900 and 79,999 miles sold for approximately $210 more than cars with values between 80,000 and 80,100 miles. However, they sold for only $10 less than cars with readings between 79,800 and 79,899. The left-digit bias meant that the negative effect of crossing the threshold from 79,999 to 80,0000 miles was far greater.

Researchers Thomas and Morwitz studied “charm prices”, and realized that people perceive nine-ending prices as smaller than those one cent higher when the first digits of the prices are different (e.g. $8.99 and $9.00). And when the two prices being compared are closer, it increases the power of this effect.

Source: BlindSpot

Just like any other strategy, even this one has a caveat. Using $.99 creates the impression of getting a good deal, but round numbers often indicate higher value (higher quality items). Which one you should apply depends on the type of market segment you’re in as a business, as both invoke different perceptions.

Here are a few tips on how you can implement the left-digit-strategy in your business:

- Change your prices to end with 9 – $16 to $19; $73 to $79; $233 to $239

- Add $0.99 to your prices – $19.99; $79.99; $239.99

- Discount prices so they end with 9 – $16 to $9; $73 to $69; $233 to $229

However, while this might skyrocket your sales, you need to look at the pricing strategy from a different point of view. It should be a system across your entire business, and therefore you need to consider the customers’ decision-making process and the decoy effect.

Tips on how to make your customers feel safe

When we make any purchases, especially online, we want to be safe and be sure that we won’t lose our money. There are some useful tips on how to assure your customers and make them feel good about their decisions. Let’s have a look.

Refund policy

Sometimes, customers aren’t 100% sure whether your product or service is the right fit for them and will meet their needs or solve their problems. To address this, placing a clear refund policy on your website will assure them and make the purchase feel less risky.

Free returns

A small step for a company, but a big effect on the customer experience. Offer your customers free returns and relieve them of any additional costs.

One step at a time

Rather than a single form, start the payment process by asking for simpler information at the beginning like their name and email address. Once they’re already engaged, proceed to card details at the end.

Remove currency symbols

By removing currency symbols, you diminish customers’ association with money.

If the currency has to be visible to your customers, minimize its font. This change will have the same effect as if the currency symbol was removed.

Trust symbols

By adding trust symbols like Norton, or TRUST-e to your paywall, you reassure your customers that their payment and card details are kept safe, and that the payment is secure.

Summary

What is the pain of paying?

An uncomfortable feeling accompanied by negative emotions experienced during the payment process. The level of pain of paying differs according to the payment method and can lead to reducing spending or avoiding it altogether.

How can you use the pain of paying in business?

There are numerous approaches you can implement in your business strategy to reduce the pain of paying for your customers and actually make the payment process more comfortable.

- Payment cycles – design payment cycles as 2-3 larger payments during the year. But keep in mind your customers’ lifestyle and cash flow.

- Mobile payments – give your customers an option to pay with their mobile phone, as this diminishes the connection with real money and reduces the pain of paying.

- Upfront payments – people prefer to pay in advance for goods and services. This is also known as prospective accounting. If you want to make your customers enjoy your product more, use this knowledge to your advantage and offer them an option to pay in advance.

- Bundling – sell your products in bundles or packages, with a slightly discounted price.

- Offer something for free – it could be a small gift added to your customer’s order, free shipping, or a free 7-day trial, the possibilities are endless. However, be careful, as once you offer something for free, you should not charge for it later, as this will drive future customers away.

- The left-digit effect – change up your pricing game and tune up your existing prices to end with 9, add $.99, or discount already existing prices so they end with 9.

- Assure your customers – give your customers peace of mind by adding the refund policy, information about free returns, and trust symbols to your payment page or paywall, and remove currency symbols.